Equipment financing can equip your business for success by keeping working capital in your hands. Paying cash for a piece of machinery requires paying in full before the machinery is productive and able to contribute to your revenue. Whether you choose to finance equipment with a loan, rent equipment with a lease, or create a custom financing option, there are plenty of ways to avoid a large cash outlay.

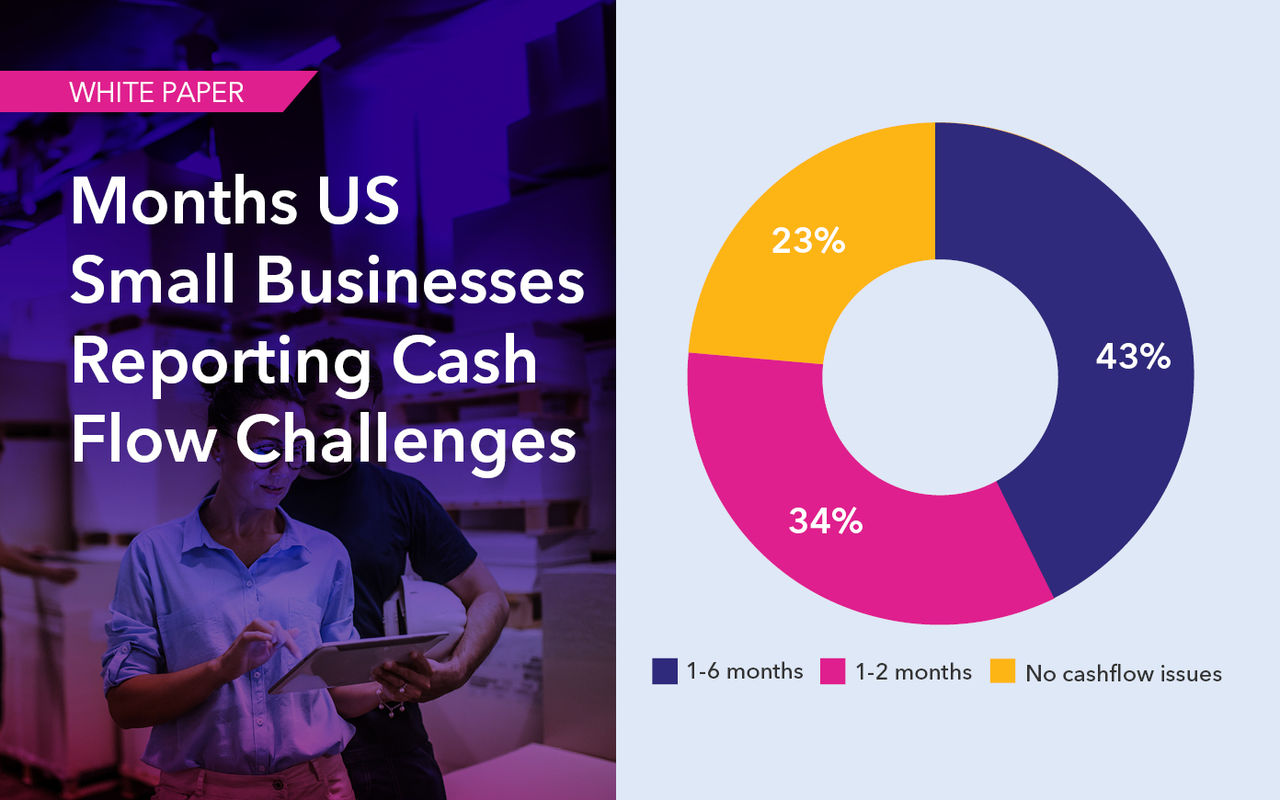

Equipment financing allows you to set up customized payment plans, maintain and manage cash flow, and acquire the materials you need to do business. And it’s becoming more popular; according to the Equipment Leasing and Finance Association, the equipment finance industry saw new volume increase over 7% in 2021, making this $900 billion sector a key one.

Financing is used by businesses across all industries and service sectors, but the top five most financed equipment types are: transportation; Information Technology and technology services; construction; agriculture; and industrial/manufacturing.

Loan or lease?

Depending on your needs, you might consider an equipment loan or an equipment lease.

Businesses of all sizes—from Fortune 500 companies to mom-and-pop shops—can benefit from these arrangements.

Both loans and leases allow you to access equipment immediately, enabling you to generate revenue—while you begin making small, periodic payments.

In general, a loan is better if you have excess money for a down payment and you plan to keep the equipment for a long time. A lease is better if you don’t have money to put down, the equipment is only needed for a particular project, or if there is a risk of it becoming outdated.

Below are some things to consider.

Equipment loan (line of credit)

Good for: Equipment you want to own immediately and permanently; items that are central to your core business and in constant use to generate revenue; and inventory purchases, business improvements, and capital expenditures.

Payment: The bank provides a loan, and the borrower makes payments with interest. An equipment loan usually requires a down payment. You own the equipment [outright/lien-free] at the end.

Pros:

Lending is based on fixed business assets used as collateral.

Immediate tax deduction.

Enables expense planning.

Generous credit approval since assets are used as collateral.

Simpler to obtain than a traditional bank loan.

Typical industry uses: inventory purchase, business expansion, heavy machinery, and power equipment.

Equipment leasing

Good for: Equipment you need to use but have the option to purchase; items/technology that may become obsolete; project-specific equipment that you don’t need long-term; and equipment you expect to use for 36 months or less.

Payment: May allow for100% financing with no down payment. Monthly payments are customized to your needs. The lease finances the equipment’s value, which decreases over time.

Pros:

The leased equipment serves as the collateral.

Related services can be bundled: maintenance, service, installation, etc.

Lender can become administrator of equipment management, delivery, maintenance and disposal.

For growth companies, multiple lease contracts can fall under a master lease.

Typical industry uses: machinery; IT hardware and software and services; healthcare technology; medical equipment; and security systems.

Call Pathward for a flexible financing solution at 888-999-8050.