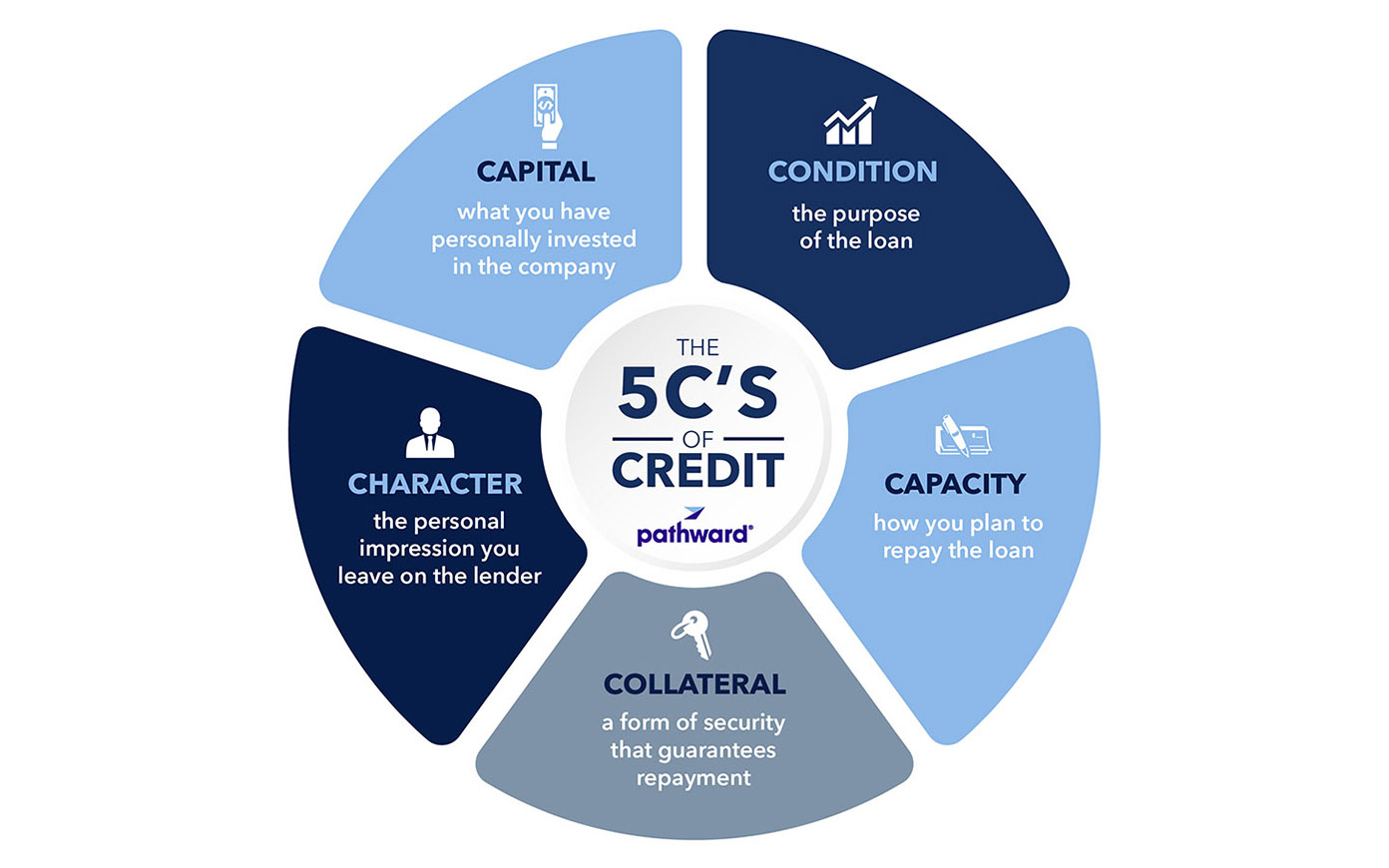

How does a lender know if a borrower is a good risk? Before offering a loan, lenders assess several criteria to determine whether they’re eligible for a loan. There are five key factors most lenders will consider, which are known as the Five C's of Credit.

- Capital

- Condition

- Capacity

- Collateral

- Character

Each factor helps the lender evaluate the borrower’s commitment to the business and overall credit worthiness. Together, these criteria influence the final loan decision. Here’s how the 5 C's breakdown into the factors under review: